Bitcoin mining has evolved from a novel venture into a booming industry, one that resonates deeply within the economic fabric of nations around the globe. In Argentina, a country of diverse landscapes and challenges, the question arises: is investing in Bitcoin mining truly worth it? With a rich context of innovation mixed with economic instability, Argentina presents unique opportunities alongside significant risks. Let’s explore the intricacies of Bitcoin mining in this South American nation.

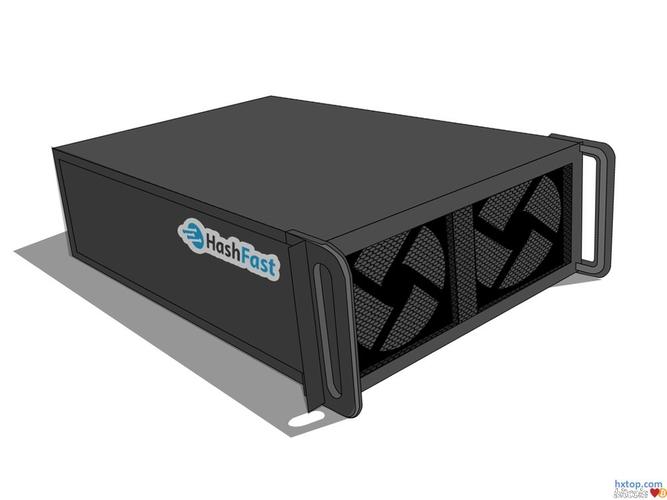

Firstly, it’s essential to understand what Bitcoin mining entails. It is not merely the act of generating new bitcoins; it’s an intricate process involving complex algorithms that ensure the security and integrity of the blockchain. Miners use powerful machines, known as mining rigs, to solve these cryptographic puzzles, thereby validating transactions and adding them to the public ledger. In high-demand locations like Argentina, increased electricity costs and regulatory unpredictability can complicate this process, making the choice to invest more nuanced.

The rise of Bitcoin in Argentina can be attributed to various factors, including inflation and economic instability. With the country’s annual inflation rate often hovering around alarming figures, many Argentinians have turned to cryptocurrencies as a hedge against the devaluation of their national currency, the peso. The ease of accessing Bitcoin offers a semblance of financial security in an otherwise tumultuous environment. This shift can create a burgeoning market for mining operations despite the challenges.

With electricity being a critical component of mining, the cost-effectiveness of running a mining operation is paramount. Argentina’s energy market is undergoing significant transformation, with the potential for untapped renewable resources such as wind and solar power. In isolated regions, where energy costs can be lower, innovative minds are steering mining operations towards sustainability while seeking profitability. Establishing mining farms in these locations not only benefits miners but contributes positively to the local economy by creating jobs and promoting technological advancements.

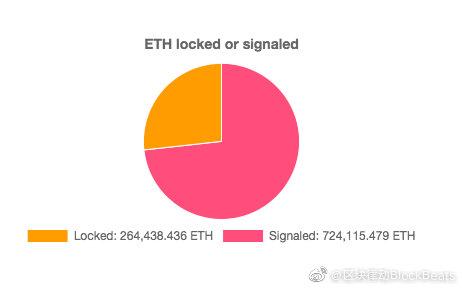

Diversification in mining operations is another critical aspect. Many miners in Argentina are not just focused on Bitcoin; they are exploring smaller altcoins like Dogecoin and Ethereum that can also be mined. The versatility of mining rigs allows enthusiasts to switch between mining different cryptocurrencies based on profitability and market conditions. This flexibility can be a game-changer in the ever-fluctuating landscape of cryptocurrency prices.

The role of exchanges in this ecosystem cannot be overlooked. Many Argentinians are now familiar with platforms that allow them to trade Bitcoin and other cryptocurrencies, thus creating a more vibrant market. The increasing adoption of exchanges facilitates liquidity, enabling miners to quickly convert their mined currency into pesos or invest in more mining equipment. As the cryptocurrency market matures in Argentina, local exchanges are likely to factor into the decision-making process for would-be miners.

However, every investment carries its risks, and Bitcoin mining is no exception. Prospective investors must consider the volatility of cryptocurrency prices. While Bitcoin has seen tremendous appreciation over the years, market corrections can be sharp, and investment recovery can feel elusive. Additionally, it’s vital to understand the regulatory landscape; a sudden shift in government policy regarding cryptocurrency could render a significant investment obsolete overnight. Thus, due diligence is essential.

Moreover, the aspect of community cannot be ignored. In Argentina, a strong network of miners is forming, often sharing best practices and lessons learned through trial and error. This community spirit can be a source of empowerment, enabling novices to enter an otherwise intimidating market. Knowledge-sharing can lead to innovations in efficiency, ultimately fostering growth across the sector.

In conclusion, Bitcoin mining in Argentina presents both remarkable opportunities and significant risks. While the challenges posed by the economy and energy costs require a strategic approach to investing, the potential for financial security through cryptocurrency remains enticing. By understanding the delicate balance of factors involved—from the economic landscape to the community and innovation driving the industry—investors can make more informed decisions about whether to venture into the world of mining.

As with any investment, caution is key. By keeping abreast of market trends and technological advances, Argentine miners can position themselves favorably within the vibrant yet unpredictable realm of cryptocurrencies. Ultimately, the question is not only about whether it is worth investing in Bitcoin mining but how one can turn those investments into meaningful opportunities for growth and financial stability.

This article delves into Argentina’s burgeoning bitcoin mining landscape, examining its unique advantages—like cheap energy and favorable regulations—while candidly addressing the challenges of fluctuating markets and technical expertise. It offers nuanced insights, making it a must-read for potential investors weighing risks against the promising returns in this volatile sector.