The year is 2025. The digital landscape has transformed, irrevocably shaped by the relentless march of cryptocurrency. Bitcoin, once a fringe experiment, now hums beneath the surface of global finance, a foundational layer upon which new economic models are being built. Ethereum continues to evolve, its smart contracts powering decentralized applications that are reshaping industries from healthcare to supply chain management. And Dogecoin? Well, Dogecoin maintains its peculiar charm, a testament to the power of community and the enduring appeal of internet culture in the world of digital assets.

Navigating this dynamic landscape requires a nuanced understanding of the forces at play, particularly when it comes to mining investments. The days of plugging a single GPU into your desktop and hoping for a windfall are long gone. Mining in 2025 is a sophisticated, capital-intensive undertaking, demanding strategic foresight and a keen awareness of market trends.

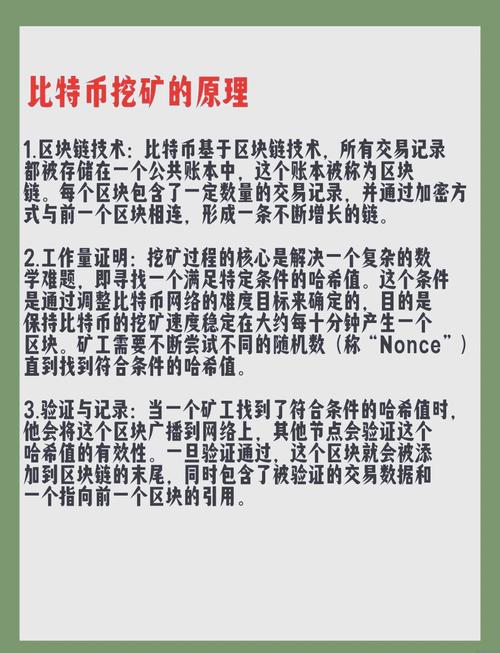

The core of this revolution is the mining machine. These specialized pieces of hardware, purpose-built for solving complex cryptographic puzzles, are the engine of the blockchain. Their efficiency, measured in hash rate per watt, dictates profitability. Investing in the right mining rig is paramount. Consider the application-specific integrated circuits (ASICs), powerhouses of computational ability meticulously designed for specific algorithms, like Bitcoin’s SHA-256. Or perhaps explore the versatility of GPU-based miners, still viable for algorithms favored by Ethereum and other altcoins.

But owning the hardware is only half the battle. The cost of electricity, coupled with the ever-increasing difficulty of mining, necessitates strategic partnerships and efficient infrastructure. This is where mining machine hosting comes into play. Hosting providers offer a crucial service: housing and maintaining mining equipment in purpose-built facilities, often located in regions with access to cheap and abundant energy. These mining farms are becoming increasingly sophisticated, employing advanced cooling technologies and sophisticated monitoring systems to optimize performance and minimize downtime.

Choosing the right hosting provider is critical. Look for facilities with redundant power supplies, robust security measures, and experienced technicians on site. Furthermore, consider the location of the facility. Proximity to renewable energy sources, such as hydroelectric dams or solar farms, can significantly reduce operating costs and environmental impact. A commitment to sustainability is not only ethically responsible but also increasingly important to attracting investors and maintaining a positive public image.

The competitive landscape of cryptocurrency mining is fierce. As Bitcoin block rewards continue to halve, miners are forced to become increasingly efficient to remain profitable. This necessitates a constant evaluation of hardware upgrades, algorithm optimization, and energy consumption. Furthermore, miners must be adept at navigating the regulatory environment, which varies widely from jurisdiction to jurisdiction. Some countries embrace cryptocurrency mining, offering incentives and favorable tax policies, while others impose strict regulations or outright bans.

Beyond Bitcoin, the world of altcoins offers a plethora of mining opportunities. Ethereum’s transition to Proof-of-Stake (PoS) has reshaped the landscape for GPU miners, prompting many to explore alternative cryptocurrencies such as Ravencoin or Ergo. Dogecoin, with its Scrypt-based algorithm, continues to be mined by a dedicated community, often leveraging smaller-scale mining operations.

However, investing in altcoin mining requires careful due diligence. Consider the network’s market capitalization, trading volume, and development activity. A promising project with a strong community and innovative technology is more likely to sustain long-term profitability than a speculative pump-and-dump scheme.

Exchanges play a pivotal role in the cryptocurrency mining ecosystem. They provide the liquidity needed to convert mined coins into fiat currency or other digital assets. Choosing the right exchange is essential. Look for platforms with high trading volume, low fees, and robust security measures. Furthermore, consider the exchange’s regulatory compliance and reputation within the cryptocurrency community.

In 2025, successful mining investments require a holistic approach. It’s not just about buying the fastest mining rig; it’s about building a strategic ecosystem that encompasses efficient hosting, optimized energy consumption, astute altcoin selection, and strategic exchange partnerships. By embracing innovation, fostering collaboration, and remaining vigilant in the face of market volatility, investors can navigate the dawn of this new era and unlock the immense potential of cryptocurrency mining.

The future of mining is not just about computational power; it’s about sustainable practices, community engagement, and a deep understanding of the ever-evolving digital landscape. By embracing these principles, miners can not only generate profits but also contribute to the growth and development of a decentralized, equitable, and innovative financial system.

Exploring cutting-edge technologies, shifting market dynamics, and emerging regulations, this article offers an insightful, multifaceted guide to thriving in 2025’s mining investment landscape, blending expert strategies with unpredictable global trends to redefine success.