Bitcoin mining has become a global phenomenon, but its intricacies vary significantly from one region to another. In South Africa, unique factors shape the landscape of this digital gold rush, forcing both small and large miners to navigate through a labyrinth of challenges and opportunities. Understanding the costs and the broader ecosystem of Bitcoin mining is essential for anyone considering entering this exhilarating industry.

The primary cost associated with Bitcoin mining in South Africa involves electricity consumption. The country is notorious for its fluctuating energy prices, largely dependent on the grid supplied by Eskom, which struggles with aging infrastructure and regular load shedding. For miners, this translates to an essential question: how can they mitigate elevated power costs? Some innovative solutions include harnessing renewable energy sources like solar, which are becoming increasingly popular among miners looking to offset substantial electricity bills.

Furthermore, the initial investment in mining hardware cannot be overstated. A high-performance mining rig capable of efficiently solving cryptographic puzzles is not cheap. The Priced Out Bitcoin Mining Equipment Market is becoming an increasingly concerning issue, especially for those operating on limited budgets. Miners in South Africa often have to balance the expenses of electricity, equipment, and maintenance, leading to the imperative understanding of return on investment (ROI) in this volatile market.

In addition to hardware and energy expenses, hosting mining machines brings about another layer of costs. For many, it is not feasible to set up a personal mining rig due to space, infrastructure, and technical expertise requirements. Hosting services provide an attractive alternative, allowing miners to benefit from the expertise of specialized facilities. These hosting services offer the advantage of scaling, as miners can ramp up operations without investing in additional infrastructure.

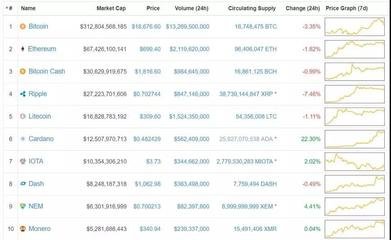

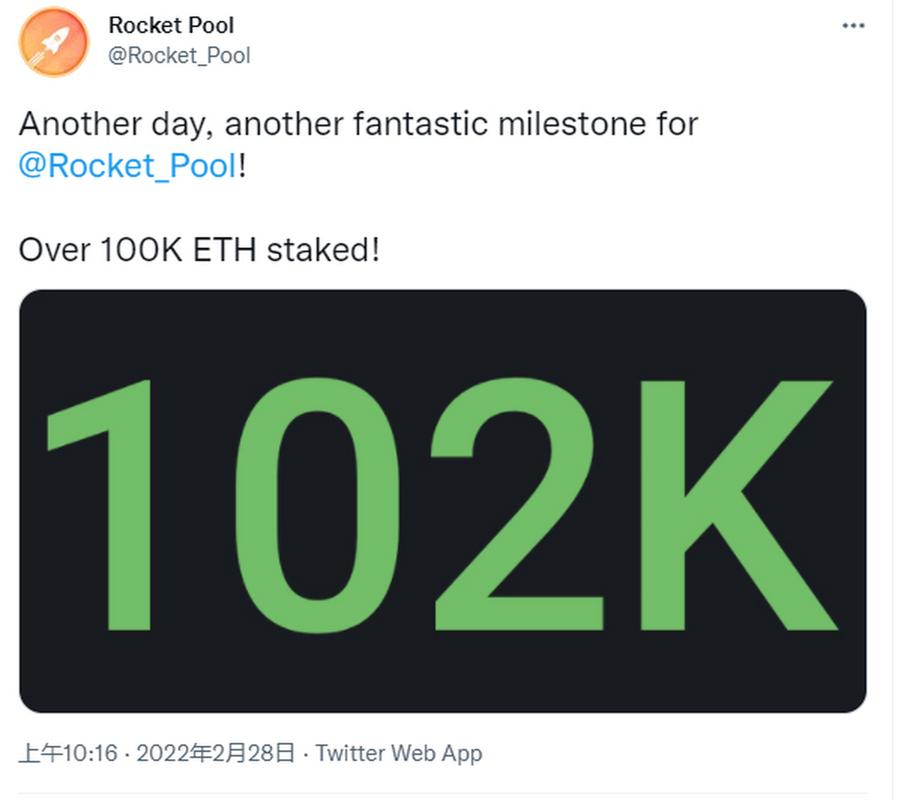

Moreover, although Bitcoin remains the standout cryptocurrency in the mining scene, other currencies like Ethereum and Dogecoin have gained remarkable traction. However, due to Ethereum’s recent transition to a proof-of-stake mechanism, the focus has shifted back to Bitcoin, bringing in more miners seeking to capitalize on its reward structure—which further emphasizes the importance of selecting the correct machines. An understanding of these currencies is crucial for anyone in the mining space, as market trends can drive profitability significantly.

Transparency regarding operational costs is vital in this competitive arena. Depending on the mining strategy chosen—whether solo mining or joining a mining pool—the costs associated with network fees and the potential for cooperation or competition can drastically affect a miner’s profits. Pools allow miners to combine their computational power, thus stabilizing potential rewards at the expense of sharing them. Such dynamics are essential for new miners to grasp to navigate through the turbulent waters of Bitcoin mining effectively.

Also, the overarching regulatory environment in South Africa influences mining costs. Government policies surrounding cryptocurrency and energy production can change with the political climate, which adds another layer of uncertainty for miners. Some have found ways to become compliant with regulations while optimizing operations, looking to license and establish legitimacy, which could also help in reducing costs in the long run.

Supply chain issues have also contributed to the costs associated with mining in South Africa. With components and mining rigs often imported, fluctuations in currency values and shipping costs can heavily impact the overall investment required to set up mining operations. This entrenched relationship between global trade and local mining is crucial for understanding the financial commitments involved in this endeavor.

In conclusion, Bitcoin mining in South Africa is a multifaceted arena filled with both challenges and rich opportunities. From energy concerns to equipment investments and the need for strategic hosting decisions, every aspect contributes to the overall costs and potential for profitability. As the world of cryptocurrencies continues to evolve, staying informed and adaptable will remain essential for miners wishing to thrive in this exciting yet unpredictable space.

This analysis offers a comprehensive look at Bitcoin mining costs in South Africa, examining key factors like energy prices, hardware expenses, and regulatory challenges. It reveals how local conditions impact profitability, providing insights for potential miners and policymakers alike. The findings highlight the dynamic nature of cryptocurrency in emerging markets.