In the ever-evolving world of cryptocurrencies, the United Kingdom has emerged as a burgeoning hotspot for crypto mining investment. For beginners stepping into this intricate domain, understanding the landscape of crypto mining—especially the nuances of mining machines, hosting services, and currency fluctuations—is crucial. Mining machines, often dubbed mining rigs or miners, form the backbone of the mining process, harnessing immense computational power to validate transactions across blockchain networks like Bitcoin (BTC), Ethereum (ETH), and even Dogecoin (DOG). Investing in these powerful devices involves more than just the initial purchase; it’s about grasping the technological, economic, and environmental dynamics that influence profitability and sustainability in the UK market.

At its core, cryptocurrency mining is a process where specialized hardware solves complex mathematical puzzles, enabling the addition of verified blocks to a blockchain. Bitcoin mining, the original and most renowned, relies heavily on high-performance ASIC (Application-Specific Integrated Circuit) miners. These custom-designed machines offer unparalleled hashing power but come at a premium price. Conversely, Ethereum mining often favors GPU-based rigs, which are more versatile but require substantial electricity consumption. For those interested in Dogecoin—a meme-inspired yet surprisingly resilient currency—the mining process is merged with Litecoin’s Scrypt algorithm, offering a different technical approach and hardware requirements.

Considering the UK’s distinct energy policies and climate, hosting mining machines locally requires strategic planning. Hosting, or colocation, is the practice of placing your mining rigs within a managed data center that provides cooling, maintenance, and uninterrupted power supply. Investors benefit from reduced overheads related to electricity costs—one of the most significant operational expenses—while avoiding noise and heat pollution at home. UK-based mining farms utilize cutting-edge infrastructure to maximize uptime, thereby enhancing mining yields. For startups or individual miners, engaging with professional hosting services might be an optimal choice, enabling a focus on the strategic side rather than technical maintenance.

Engagement with crypto exchanges forms another vital pillar of the investment ecosystem. Exchange platforms facilitate the conversion of mined coins into fiat currencies or other crypto assets, enabling investors to capitalize on market fluctuations. In the UK, regulatory frameworks are actively shaping the compliance landscape, affecting how exchanges operate and the security measures adopted. Choosing reliable exchanges with robust KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols becomes paramount, especially when handling large BTC or ETH holdings. Additionally, decentralized exchanges (DEXs) offer peer-to-peer trading alternatives, adding a layer of privacy and control, though often with increased complexity.

Market volatility remains both a risk and an opportunity in crypto mining investments. The fluctuating prices of Bitcoin—the flagship cryptocurrency—impact the return on investment (ROI) significantly. When BTC surges, mining rewards translate to considerable earnings, enticing investments in state-of-the-art miners to boost hash rates. However, downturns affect profitability harshly, especially if operational costs outweigh mined coin values. Ethereum, with its upcoming migration to proof-of-stake, signals a potential shift away from traditional mining rigs, urging miners to adapt or consider alternative currencies like Dogecoin or Litecoin for their endeavors.

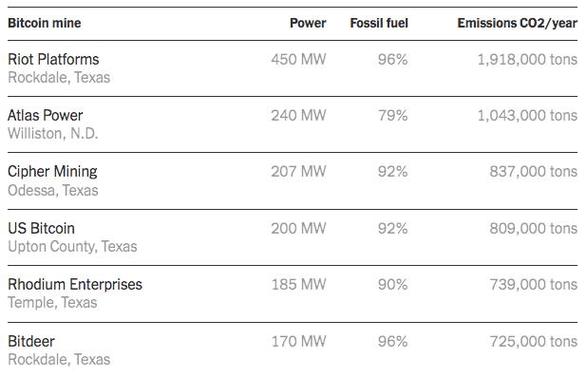

Delving deeper, the scalability and efficiency of mining farms—large-scale operations comprising hundreds or thousands of miners—can redefine money-making strategies. These farms leverage economies of scale to negotiate better electricity rates and implement advanced cooling techniques, from liquid immersion to AI-controlled airflow management. Besides pure profit motives, environmental sustainability gains prominence, prompting investments in green energy sources such as hydropower or wind farms to power mining rigs. UK investors committed to sustainable mining practices often align their portfolios with renewable initiatives, balancing digital asset creation with ecological responsibility.

For beginners, navigating the complexities of hardware selection is paramount. ASIC miners excel in Bitcoin mining but limit flexibility, whereas GPU rigs accommodate various coins, including ETH and DOG, allowing pivoting as market conditions evolve. Hosting eastern Europe’s cold climate-friendly rigs is attractive to some, but UK-based hosting services differentiate themselves by offering legal transparency, consumer protection, and sophisticated infrastructure. Investing in miners requires a forward-looking perspective—considering not just price and power consumption but also firmware support, network connectivity, and ease of scalability.

In conclusion, the UK’s crypto mining investment landscape offers immense potential for newcomers who dare to explore its depths. Armed with knowledge about mining machines, hosting options, exchanges, and the volatile yet thrilling cryptocurrency market, beginners can tailor their approach to suit their risk appetite and sustainability goals. Whether focusing on Bitcoin’s robustness, Ethereum’s innovation, Dogecoin’s community-driven appeal, or the industrial prowess of mining farms and rigs, the journey in this digital frontier is as much about strategic insight as it is about technological prowess.

This beginner’s guide to UK crypto mining investments demystifies the process with clear tips on setups, risks, and regulations, blending practical advice with market insights. Yet, it overlooks evolving tech trends—pair it with real-time data for a volatile edge!